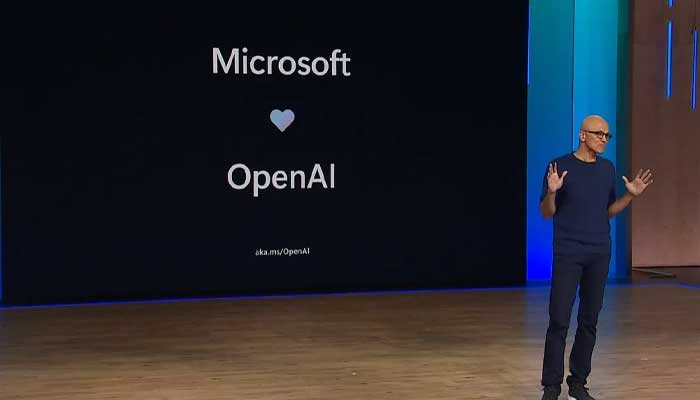

OpenAI has been engaged in fruitful discussion with Microsoft to renegotiate their existing deal.

According to Financial Times report, the aim for the negotiations is to make the tech-firm profitable and prepare it for a potential Initial Public Offering (IPO) in the near future.

The key part of these negotiations is to decide how much equity Microsoft will hold in the revamped OpenAI.

What is Initial Public Offering (IPO)?

IPO is when a company sells shares to the public for the first time, allowing potential consumers to invest in it.

Microsoft and OpenAI contract over the years

Microsoft is OpenAI's biggest financial backer - while simultaneously being a crucial part in OpenAI's restructuring efforts - as it has invested over $13 billion into the company over the years.

The first deal between the two companies was signed in 2019, which expires in 2030.

Last week, OpenAI decided to go forward with its non-profit status, while still striving to make profit as it focused on social benefits.

This corporate transformation would allow OpenAI to offer equity shares to investors, which is a major demand from investors.

As per the current contract, Microsoft has access to OpenAI's technology and new models along with a share in the revenue of product sales till 2030.