Gold and silver hit record highs amid concerns over Trump's tariff threat.

The price of gold surged to $4,689.39 (£3,499) per ounce, while silver climbed to $94.08 per ounce.

At the same time, stock markets fell as investors reacted to the uncertainty surrounding the proposed tariffs on eight European countries that opposed Trump’s plan to buy Greenland.

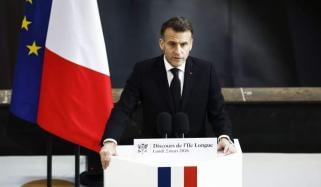

These measures will target imports from the UK, Denmark, Norway, Sweden, France, Germany, Netherlands and Finland.

Trump said in a lengthy statement, "We have subsidised Denmark, and all of the Countries of the European Union, and others, for many years by not charging them Tariffs, or any other forms of remuneration. Now, after Centuries, it is time for Denmark to give back — World Peace is at stake!"

Fears over the dispute about Greenland caused gold and silver prices to rise again, as investors bought these metals as “safe haven” investments to protect their money.

The tariff will start at ten percent and come into effect on February 1, rising to 25 percent on June 1, according to Trump’s post on Truth Social.

Reports have suggested the EU is considering responding with a €93bn (£80bn) package of tariffs on US imports.

Last year, gold prices had already increased by over 60%, partly because of global tensions and worries about the economy.